Understanding Jigsaw daytradr Connectivity & US Futures Data Fees

Update: CME Reached out to us, asking us to make a correction to this article:

“I am reaching out in regards to this post around non-professional data fees. There seems to be some confusion around a communication that our customer, Rithmic, shared and how that relates to CME Group’s data licensing policies. While it is true that fee adjustments for non-professional data came into effect on April 1, our reporting policy for non-professional use has not changed and this criteria has been in place since 2014. Rithmic was communicating changes to their customers necessary to remain compliant with their current licensing agreement. There are no broad policy changes coming on May 1.

To help avoid any additional confusion in the marketplace, we are requesting that you update your blog content to correct and clarify. Please let me know of any questions.“

We did reply asking for a minor clarification but didn’t get a response yet. We will follow up as that comes in.

Our understanding right now is that this is not so much a rule change but resolving a discrepancy between how CME and Rithmic interpreted the rules. Rithmic have been asked to report instances of 3 or more simultaneous connections to a Rithmic account by a single user. These instances will be counted as professional users after May 1st.

In other words, changes appear to be specific to Rithmic connections and Rithmic have provided a work-around for those that use more than 2 platforms.

We don’t believe that other providers are being asked to make any changes at this point.

Updated Original Post.

If you have more than 2 connections to a specific feed, you will be considered a professional trader (and pay professional fees).

With daytradr, you can use data from one account to trade many accounts. That helps save on required data connections. You can, for example use CQG data to trade both your CQG and Interactive Brokers accounts.

Jigsaw daytradr allows you to connect directly to a data feed (e.g. CQG, Rithmic, GAIN) or to 3rd party software via the Bridge (NinjaTrader 8, MT5). There’s also some ‘middle ground’ such as Interactive Brokers and IQFeed where we also connect to 3rd party software but where that might not be obvious to the user.

This is where another rule from the CME comes in.

If you connect directly to the data feed from an application, that counts as one connection. If application A connects to the data feed, and application B connects to application A to share the data, this only counts as 1 connection. Only application A is connecting to the data feed.

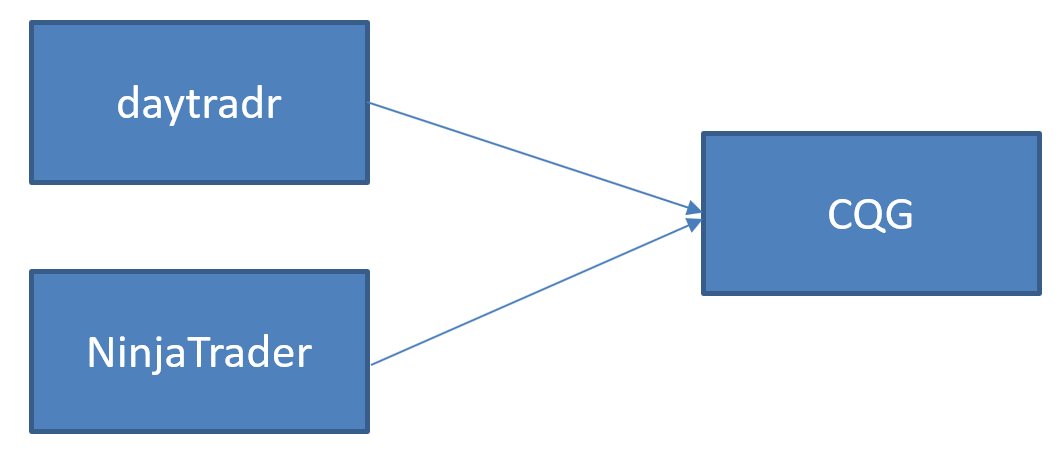

Consider the following scenario:

In this case, we have both daytradr and NinjaTrader connecting to CGQ Continuum. In both NinjaTrader and daytradr you would have set up a connection to CQG Continuum and would need to connect in order to use the data. This section of the daytradr manual covers the setup of a connection to CQG.

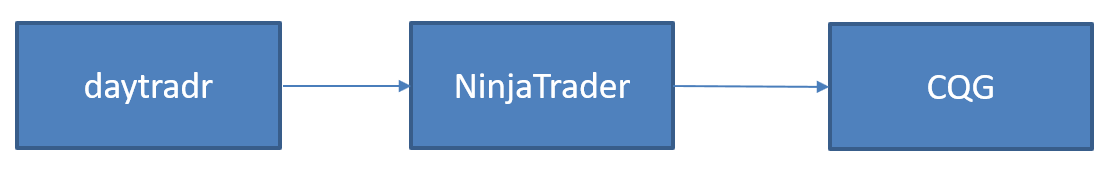

You can also connect like this:

This approach uses the daytradr bridge. In that case, daytradr connects directly to NinjaTrader and “pulls” the data from NinjaTrader. The daytradr platform does not connect directly to CQG, so this does not count as a second connection. We call this type of connection a “bridge”. This section of the daytradr manual covers the bridge to NT8.

We have bridges to both NinjaTrader 8 and MT5. There are 3 other cases where we connect to other software and where it should not count as an additional connection (but might not be obvious to the user):

- Connecting to IQFeed

- Connecting to Interactive Brokers TWS

- Connecting to Rithmic R Trader (new)

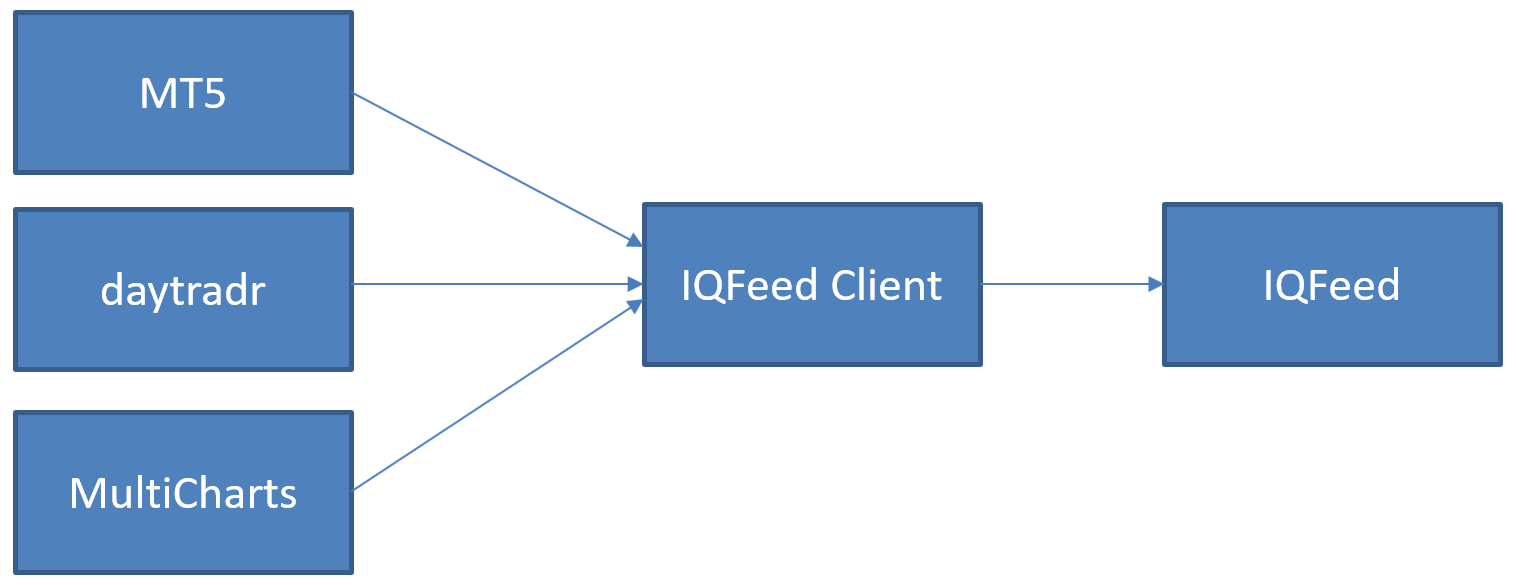

IQFeed

Many of our customers use IQFeed data feed. In this case, users install the IQFeed client on the PC and the platforms connect to that:

In this case, the 3 platforms on the left would not count as 3 connections. They all connect to IQFeed Client and IQFeed Client connects to the data service, that counts as 1 connection.

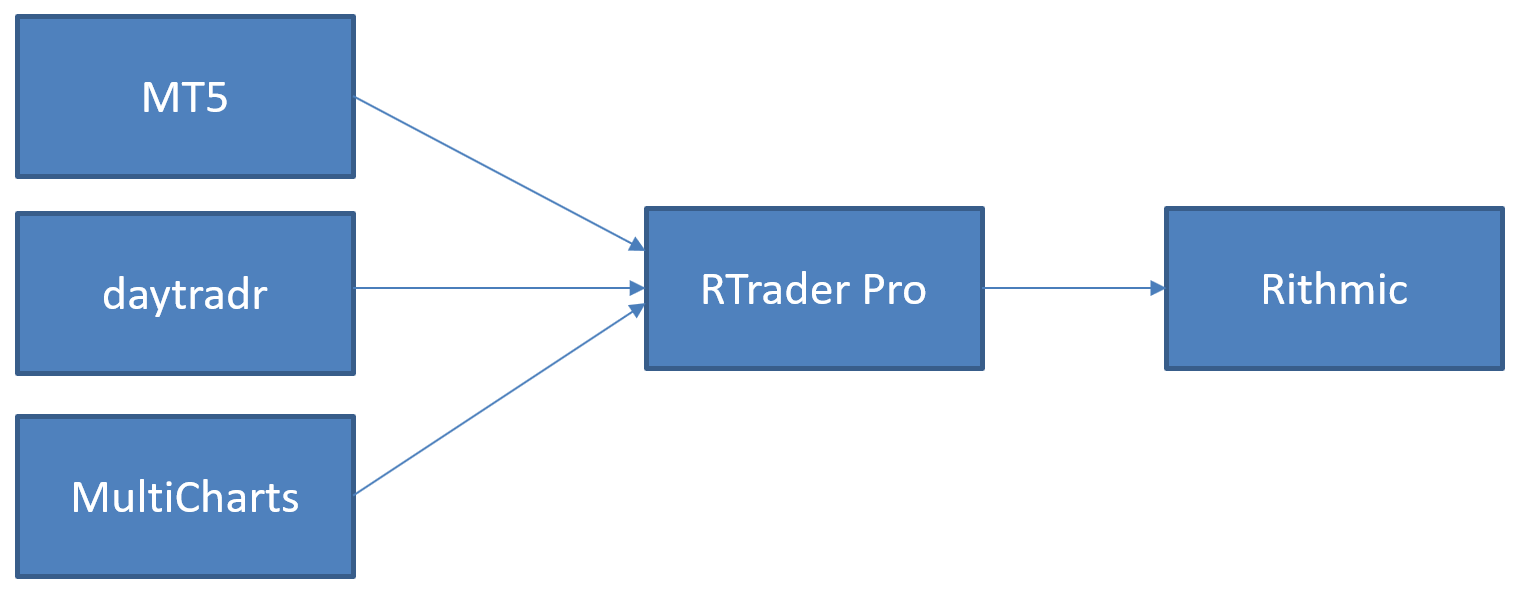

Rithmic RTrader Pro

Rithmic are introducing a new connectivity option to help counter the fees. We have already made the necessary changes in daytradr and will release something before 1st May that allows you to do the following:

Instead of connecting each trading app to Rithmic, they connect to Rithmic’s RTrader Pro . It’s like a bridge. (Note that the above diagram is just an example, do not take it as a statement that MT5 and MultiCharts have made the changes their side to connect to RTrader Pro). You start up RTrader Pro, connect each platform to it and this only counts as having 1 connection.

Connections that do NOT count as an additional concurrent connection to the CME

- Interactive Brokers TWS

- IQFeed

- MT5 Bridge (note MT5 for futures is free at AMP & some Brazilian brokerages)

- NinjaTrader 8 Bridge

- Rithmic Via RTrader Pro

If you only connect 1 platform at a time to a feed, it’s not something you need to worry about. You can connect to 1 platform, close it and then connect to another platform and it won’t count as 2 concurrent sessions.

If you connect to 2 platforms at a time to a feed, you may pay data fees for both. Currently that is $30 for all 4 CME exchanges. So $60 per month in CME fees.

If you connect to 3 platforms at a time to a feed, you will pay professional data fees for all 3. If you are subscribed to all 4 CME exchanges, that would be $105 per exchange. That’s $420 per connection or a total of $1,260 per month. It’s difficult to understand the logic behind these changes, no home trader is going to pay that.

Realistically, counting concurrency can only be done per account, so if you have an accounts 3 different brokers, it’s hard to see how CME will know you connected to all 3 at the same time. Same if you (not that it’s allowed) opened an account in your partners’s name.

The end result is that the industry will react to this new state of play. In some cases like Rithmic by offering alternate solutions that end up reducing the fees. People that now pay for 2 connections will go with a solution that allows them to pay for 1. Most likely reducing the total fees collected by CME.

FREE BONUS: Take a look into the decision-making process of professional traders with this video training series that helps you make smarter trading decisions. (Article continues below)

Order Flow itself is simply information. Just like charts, it can be used in a number of ways, some good and some bad. But let's first break down order flow into it's components so we all agree what we are talking about:

Order Executions/Tape Reading - This aspect is the real flow of orders. It's the information we see in Time & Sales, Footprint Charts, Cumulative Delta. It is looking at market orders, either as they execute or historically. I guess this is the "true order flow". Every trade is a buy and a sell. We look at market orders because we consider them to be more aggressive. When someone trades with a market orders, they are giving up a price to get an instant fill. Limit orders on the other hand just lazily sit there waiting for a market order to hit them. Often these are market makers with no directional conviction. So we see market orders as being more significant.

But we don't use these in isolation.

Volume Profile/Positions - The tape reading part helps us assess various things like momentum, traders getting stuck, balance of trade BUT the volume profile helps us understand where people are positioned and likely to get stopped out. I sometimes call this "Order Flew". It's important to know when trades will be "washed out" - for example - if we have a volume cluster on the S&P500 Futures and the market moves up 100 points and back down to it, it's unlikely short term traders on either side that were positioned there will still be there. But recent, nearby volume helps us assess areas of positions.

Market Depth - The bids and offers, the lazy passive orders waiting to be hit. This is part of the story but in terms of overall importance, I'd put it at around 20% at most. For example - if you return to the high of the day on any market, the offers will be quite large directly above the high. It means nothing at all. It's just a quirk of the market. It does not help you tell if a price will hold. On the other hand, if you see large depth and as we approach it, we see more added to the depth in front of that price, it means others are front running that depth and that is a useful bit of information.

This is the key - it is all just information. Just like price charts are information. When people look at Order Flow, they consider it to be a technique more than a set of information. They look for things like iceberg orders and decide to make a one rule trading system to fade every iceberg, For these people - yes, order flow is overrated because they are trying to ignore everything else going on in the markets and construct a trading system a chimp could execute.

For those looking to improve a decent trading approach, the best thing to focus on in Order Flow is momentum. Once you can read momentum you can:

- Avoid getting into positions when momentum is against you.

- Confirm trades are working after entry when momentum goes your way.

- Exit trades in profit when momentum fades.

That's perhaps the easiest way to use order flow because momentum is easier to read. It's about the market continuing to do what it's already doing. On the other hand, reading a turn in the market with order flow takes a higher level of skill and a little longer to learn.

Order flow can't put lipstick on a pig. It won't help you 'improve' something that doesn't work anyway, which is why whenever someone calls me, the first thing I ask is what they are currently doing and we discuss whether they need a reset or whether it will actually help.

When Jigsaw started back in 2011 - we were one of the first in the space and certainly had the best education. It was always going to attract the underbelly of the trading education/tools world and now we see stuff out there that is so complex but so impressive and futuristic that new traders are drawn to it like moths to a flame.

So here's my advice when looking at Order Flow

- Order Flow can't improve something that doesn't work.

- Order Flow can be used on it's own, without charts to enter and exit the market but you also have to be able to recognize different market states that need different/altered setups. There is nothing magical about this.

- Don't start jumping at shadows and take 50 trades an hour in your first week looking at Order Flow, be selective. It can be exciting to see cause and effect play out in front of you for the first time but don't overtrade.

- Do drills to learn how to read it before you trade it.

- Markets can only go up and down. Don't overcomplicate it. If you have too many Order Flow tools on your screen - you will not be able to make consistent decisions. Less is more.

- Take time to choose a market with a pace you like. Interest rates might send you to sleep, the DAX might give you a heart attack.

It is hard to see how a set of information could be overrated. It is true that some methods of presenting this information are better than others. It is also true that some people simply get on better with different tools (e.g. Footprint vs DOM).

There's a middle ground between complexity and simplicity that will leave you making consistent decisions where you improve over time. For those people, Order Flow will be way underrated because they will be the one's getting the most out of it.

Those that jump in with both feet on day one and those that have 100 different tools up, for those, it's a painful experience.

Keep it simple and manageable. Start with momentum reading and build from there. You will never look back.

0 Comments