All Bets Are Off!

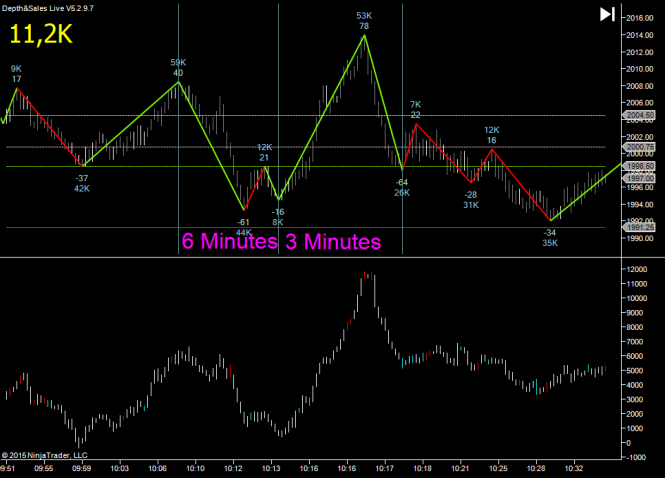

We got hit with some major volatility yesterday with a 19.5 point move up in 2 minutes (but only 53k contracts traded) and then a 1 minute 16 point drop, again with just 26k contracts traded. Big swings with relatively low volume means that the liquidity disappeared. Just after that, a fellow trader sent me a link to this article….

The Market Has Just Gone Nuts | Zero Hedge

The upshot being that there’s US$1.1 trillion in S&P500 options expiring Friday with a lot of them being puts just below where the market is.

Now – a couple of things to consider there.

1 – People tend to overblow the numbers when they talk about derivatives. The nominal value of a single emini S&P500 contract is a little over $100k but obviously when you trade a contract, you are not risking $100. So when people report numbers, they tend to do so in the most newsworthy manner. So there is a tendency to pump up the numbers to the highest one that fits.

2 – Regardless of the fact the market is overweight puts, there were buyers and sellers of those puts. So there’s people on both sides of that trade, people that will benefit if it goes down, people that will benefit if it goes up.

3 – Many of the puts will not have been speculative trades but hedges, so some of the holders wont care what the market does.

But still – that’s a lot of money on the line and we can’t expect either side to just sit by the sidelines and wait it out.

Tennis is not considered a dangerous sport, but it becomes dangerous when playing in a court full of elephants. In my opinion, that’s what we have today. We have a potential FED rate hike (or not) and we have a lot of people that stand to benefit and lose based on where price ends up on Friday. So it could get interesting.

My own method of looking at the market is to look for areas I think speculators might jump on board and then joining when they do. I don’t think this is that type of market. That presumes that speculators are the main players and that liquidity providers are doing their job in a fairly safe environment.

I think the market conditions – will cause liquidity providers to be extra cautious (i.e. missing) and for speculators like myself to be less significant. There is the potential for the markets to get pushed around.

In short, it’s more dangerous to trade right now and in addition, my own method of analyzing the market is based on a set of presumptions that cannot be relied on from here till Friday.

That doesn’t mean you can’t trade it. I will watch it and see and possibly try to scale into a trade if the market puts in a run. If liquidity disappears, I won’t even try that.

BONUS: Take a look into the decision making process of professional traders with this video training series that helps you make smarter trading decisions.

0 Comments