The Jigsaw Guide To The End Of The World

Following on from our recent article “The Eternal Quest For The Market Bottom!“, we see that pundits are still hard at work predicting the end of the move. In this gloriously silly article from Barrons, we can see that the market was definitely going to stop at 2990 or 2750 or 2630 – take your pick, they were all proven to be nonsense.

Let’s see how well this India Times article does – which predicts a market bottom within the next 3-4-5 trading sessions. There’s 2 sessions of that left by my calculations…

We don’t expect the financial media to behave any better because their job is to generate noise, to sell advertising in their publications. They are just playing the tune the lumpen-investor wants to hear, which seems to be “after 10 years moving up, a few weeks of pullback means it’s time to start buying again“. Good luck with that.

Comparisons to previous sell-offs seem to be rampant but unless we go back to the 1918 Spanish Flu pandemic, it’s hard to see how comparisons to 2008 or other recent crashes are relevant. The Dow Jones sold off only 11% during the 1918-1920 pandemic and we are way past that. There are other weaknesses in today’s markets (like corporate debt) that may compound the Corona-Crash. If airlines are grounded and people are being told to stay at home over the coming weeks, there could be a cascade of bankruptcies, redundancies and mortgage defaults and that triggers a bigger crash. There’s plenty of shoes that didn’t drop yet.

Governments don’t seem to have caught on that they aren’t very good at fixing situations like this. Their attempts to shore-up the markets with 0% interest rates and trillion dollar asset purchasing programs reek of desperation. In turn, the markets’ response is to carry on down anyway. With interest rates having nowhere to go but negative, maybe we’ll see what happens when the smart people at the Fed just let things work out on their own. Given today’s failure to halt the fall by the Fed – what do we expect other Governments around the world to do now? Most likely – more of the same, with the same results.

Traders aren’t faring much better either. This is a market where 99.99% of traders should stay away and I certainly include myself in that number. The lack of liquidity means your market is no longer behaving as it usually does. Your setups won’t work, your approach to stops won’t work. I’ve spoken to a number of traders that are doggedly insisting on playing this market and the most common reason when asked why is “it’s a good learning experience” (a bit like a surfer grabbing his board on hearing a tsunami warning – because it’s ‘good for experience’). What this really means is that the trader can’t stop, it’s indicative of compulsive behavior. There are some people that simply cannot stop trading, not even for a day. So they carry on, reinforcing poor behavior, decimating live and SIM accounts and building up more negative associations with their trading activity. Cripple yourself financially and emotionally or have a few weeks off and catch up on Netflix – I know which I’d choose.

Look to the Futures Brokerages. They only make money when you trade live. They are all upping margins to protect themselves. In turn they make less money because you can’t trade the same size. If that’s not a message you should take to heart as a trader – that your broker is trying to get you to trade less – then I don’t know what is.

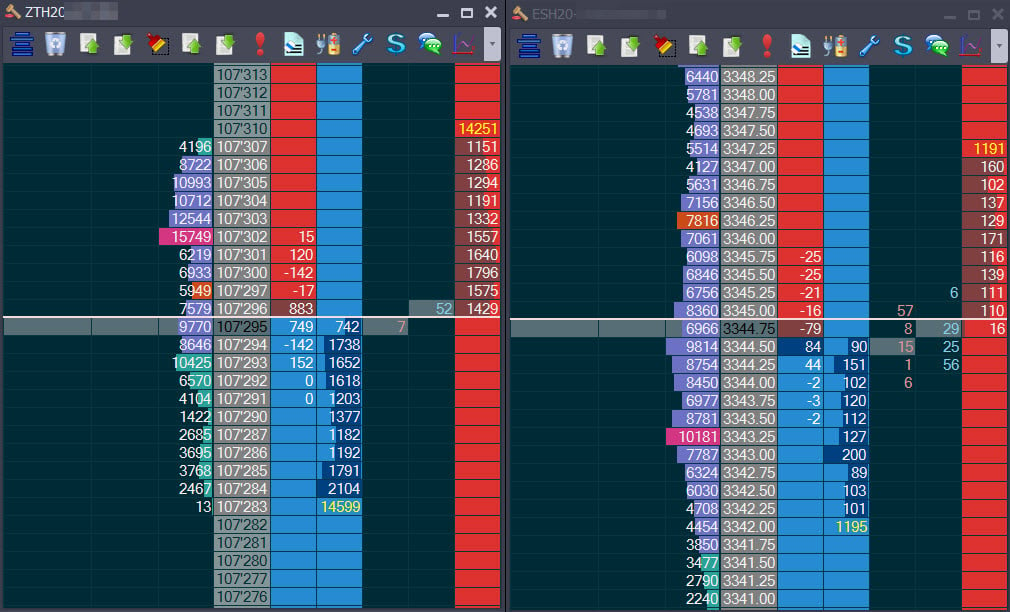

For new traders, looking to cut their teeth on trading or those looking at Order Flow for the first time – it’s a bit frustrating because they want to engage with the markets. The only sensible thing to do it step down to traditionally much slower markets. Here’s the 2 year Treasury Note next to the S&P500 Future back on Feb 6th this year:

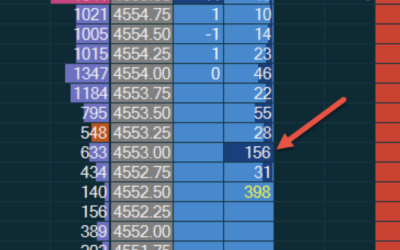

As you can see – we have thousands of contracts at each level on the bids & offers as well as actually trading on the Volume Profile. Here’s the 2 Year T-Note today:

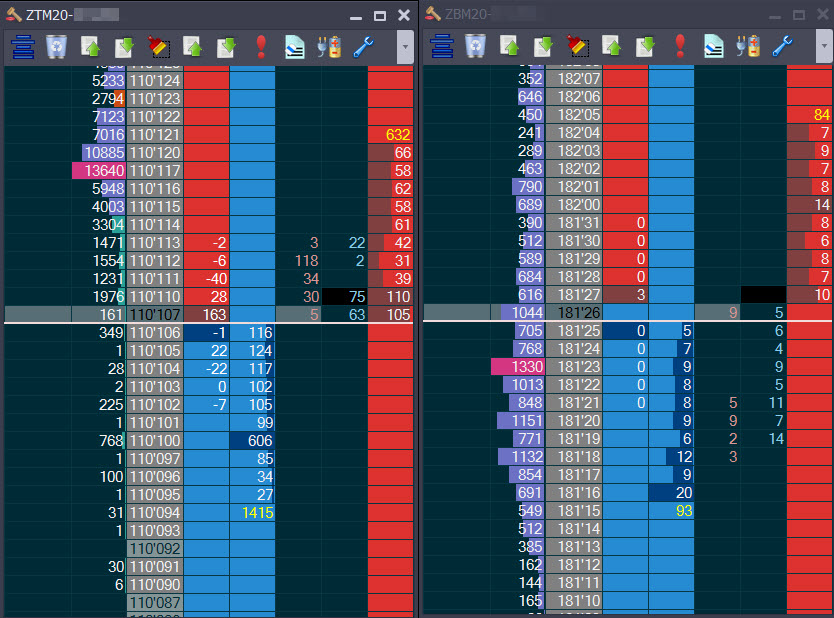

As you can see the depth is about a 10th of what it was a month ago – but it’s still moving slowly enough to be able to read. The Treasury Bond (ZBM20 on CBOT) to the right is typically a much thicker instrument but it looks like the DAX today (if you don’t know the DAX, it’s a very thin, very volatile instrument on Eurex).

For beginners looking to learn about how markets move, you are much better off watching these slower markets. If you have drills to do, then ZT, ZB, UB, ZN will all provide a range of ‘reasonable’ volatility for you to practice with.

So by all means practice your drills & hone your skills. If you want to carry on with your S&P500 Futures setups – take them to a thicker market. The S&P, the NASDAQ Futures are total madness right now.

And the bottom? Well there is no doubt that the Corona-Crash will represent a great buying opportunity at some point but nobody really knows how low we are going to go. The only reasonably sure thing is that when we hit the low, we’ll start moving up again at some point. What we can’t be so sure of is if we’ll hit the 2020 highs again. We could be back there in 12 months or not see them for 10 years.

That’s the quandry, these sell-offs are ALWAYS a buying opportunity at some point. Just that nobody knows exactly where the perfect buying point will be. Certainly not the financial media. If you take a ‘one-shot’ approach to getting into this market, then you put yourself into a position where you need to know the low. On the other hand, building a sensible position over time without having to know the lows just means that at the time we hit the low, you’ll probably still be sitting on cash you didn’t invest yet. Much better than praying for the market to come back because you went ‘all in’ way too early.

Simplify Your Trading

Take a look into the decision making process of professional traders with this video training series that helps you make smarter trading decisions.

0 Comments