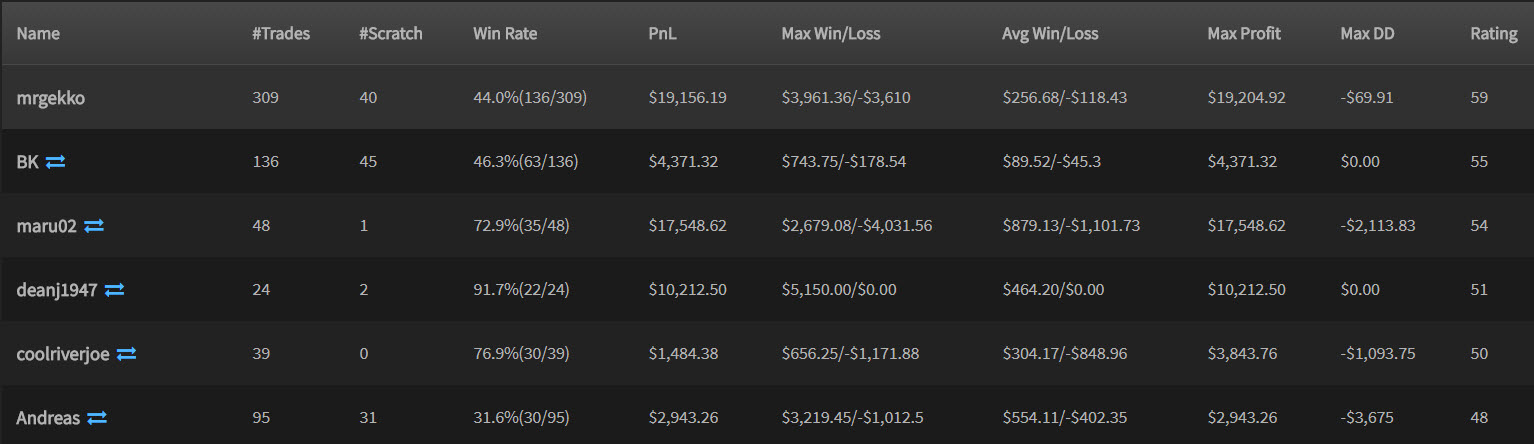

November Leaderboard Results – Mr Gekko wins $500, Maru02 most improved!

The November leaderboard results are in and the competition is hotting up. Mr Gekko took the top spot again, this time with a consistency rating of 59 and PnL of $19,156.19 for the month. As you can see from the top 5 – PnL is not the deciding factor… but consistency rating.

The most improved trader is Maru02, bringing in $17,548.62 on his live account and hitting a rating of 54, that’s compared to a rating of 39 in October.

His account is a little more swingy & because of that, he’s getting rated down a little. That doesn’t mean he’s not a great trader, it’s just that by the “go-live” criteria used at the prop firms we know, he’d be rated lower (I’m sure he’d still get funded though). I certainly wouldn’t tell him to do anything different to try and win the $500 – and I imagine it won’t belong before he wins a month anyway.

Right now, just 100 brave traders are signed up for the leaderboard, which represents just a few percent of our user base. This isn’t just about winning – it’s about improving. And some notable improvements this month among the following traders

- MilleniumTrader, MaTrader & TradeTheMarket83 – getting to profit this month and boosting your rating by over 30 points! Great Improvements.

- BastiaanDeHaan, DeanJ1947, DogPaddy, MarcoChapuli, Beekay – on very nice swings in your P&L this month too.

We’ll soon be putting up some improved reports for traders to track their leaderboard improvement over the months – so if you aren’t on there now, sign up. Not only can you win a prize but the rating is a great way to track that you really are on target with your trading. You don’t have to show your real name (yes – DogPaddy is an alias) so don’t let your current performance put you off – this is all about making improvements.

Simplify Your Trading

Take a look into the decision making process of professional traders with this video training series that helps you make smarter trading decisions.

0 Comments