Mid-Term Election Week – What Traders Need to Know

This week, we have a major market impacting news event – the US Mid-Term elections. That means it’s time to consider the potential impact as traders.

I think it would be a mistake to try to predict the market reaction of the Democrats taking the House and/or Senate. Let’s keep the predictions for the pundits. What we do need to assess is the potential of any market shifting news during the trading day. We know that many people consider the Trump administration to be pro-business. We know that the democrats taking the House/Senate is a shift of power. If there’s major changes in the balance of power, it is logical that the market would react. On the other hand it’s possible that the market has priced in this result as it seems likely, so no change might be a market moving event. Rather than making predictions, I am going to stick to staying out of trouble!

So here’s how I’m looking at the week…

Monday – Day before election. Increased news risk during the day as the media hype up their favored side. If either side can manufacture a crisis at this point, they will. So eyes and ears on the news feed.

Tuesday – Election day. Usually fairly quiet, campaigning not allowed. News is subdued too. News usually starts more aggressively once the polling stations have closed – so well after the US market closed and into Wednesday AM in Asia/Europe. As the evening progresses, any changes start to become clear and start hitting the market

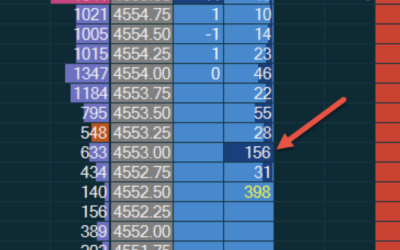

Wednesday – By the time the US markets open, there will have been some reaction in Asia/Europe. Going into the day, if the overnight moves seem large and the results are deemed ‘unexpected’ or ‘unfavorable to business’, then look for repositioning during the day, high volatility, reduced liquidity and extended moves.

Thursday/Friday – Ears/eyes on the news for result disputes, major policy announcements (or announcements policies will be blocked).

As we move into the following week, we should start to see things calm down. If the republicans get a favorable result, we should see things calm down much sooner as it’s back to status quo. If not and we see a power shift, we may see plenty of volatility over the next few months as these opposing sides figure out how to “work together”.

As for predicting the result or the market reaction to any result, that’s certainly beyond my skill set. The keys are to recognize if moves are news driven and proceed with extra caution in the first few days/weeks if there is a shift in the balance of power.

And to those of you that decide it’s just easier to stand aside during the election – check out this video of a real, live money $100,000 trade video!

Simplify Your Trading

Take a look into the decision making process of professional traders with this video training series that helps you make smarter trading decisions.

0 Comments