Jigsaw Swing Charts Webinar with a $500 cash prize!

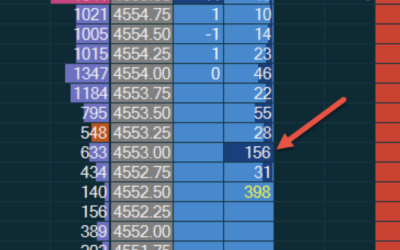

We’ve always been a fan of Swing charts as they provide a unique insight into market activity. Interestingly, it’s not because they show more information but because they filter out a lot of noise and focus on 2 main data points – where did the market react? and which side of the market was trading more aggressively? In turn, this helps you understand if the market is going to continue or if it’s done in the old direction and a new trend is in place. It’s great for bias, it’s great for trading pullbacks. We’ll show you how to use them and for the first time, we’ll be showing the new Jigsaw Charts, which will be beta release in July.

The webinar is our contribution to the upcoming Wealth365 July 2020 Summit. It’s running from 13th to 18th July and will feature 60+ speakers through the week. Click here to register, your email will not be shared with any 3rd party by W365.

We are also giving away 4 prizes to those that register. The first prize is $500 cash followed by 3 runner up prizes of $500 off any Jigsaw software/educational product.

We don’t have the exact date/time of our spot but you’ll be informed when the schedule is released if you register. The main focus of the session will be:

- How to accurately recognize a reversal in the market

- How to estimate where a market pullback will end

- Understanding how shifts in volatility can be measured, so you can adjust your entries

- When to stand aside and not take trades

- Confirming the trades with Order Flow

- Putting it all together into a successful trading strategy

Click here to register for this brand-new webinar.

Simplify Your Trading

Take a look into the decision making process of professional traders with this video training series that helps you make smarter trading decisions.

0 Comments