Iceberg Orders by Axia Futures

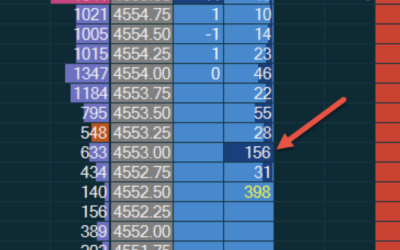

If there’s one topic that comes up again and again in customer emails/discussions – it’s Iceberg Orders. In fact, it came up in yesterdays December Open House session. There are different types of iceberg orders, some easier to see than others.

In short an iceberg orders are “Orders that are real, but hiding“. This is very different from a large resting bid or offer (limit orders) which is “An order that is not hiding and is probably not real“. This is why order execution based information (like iceberg orders) is more reliable that market depth based information such as large resting limit orders. They mean very little more than “this is an area of interest”.

There are times when you can front run large limit orders and we cover that in the “Introduction to Scalping video” on the Jigsaw members site. Professional firms focus more on the flow of orders and areas where positions are resting. Mostly because that information yields better trading signals.

It’s great to have different perspectives on these topics from professional traders. In this video, we hear professional trader Alex Haywood’s interpretation of one type of tradable iceberg activity. He first discusses different types of iceberg orders and how some aren’t that easy to identify in real time. Alex, focuses on one example of an iceberg type that you can see, that you can trade and that has an excellent risk:reward ratio.

Alex walks through the action and discusses how you could trade it. He also mentions at one point how he feels it’s an imperfect setup, not so much because of what the iceberg is doing but because of what a correlated market is doing. For more on how to use correlated markets with absorption check out our free December Open House session.

The video comes from a live mentoring session at Axia Futures – straight from a Prop Firm in the heart of London’s financial district. Of course, using the features of the Jigsaw tools to identify the iceberg as it evolves.

A big thank you to Axia for making videos like this available to the public. It’s a big help for those trying to figure out what trading is really all about.

Simplify Your Trading

Take a look into the decision making process of professional traders with this video training series that helps you make smarter trading decisions.

0 Comments