Group Therapy – Market Correlations – Recording

Last week, we held our monthly group therapy session and this time the focus was Market Correlations. The recording for the webinar has now been uploaded and can be seen below.

In this month’s session, we addressed the new appetite many of you have for a discussion on Market Correlations. I say that because to be honest, a lot of traders feel this topic a little bit boring. Normally, when we do a webinar, the dropout rate (people that leave during the event) is less than 1%. For market correlation related topics, it’s more like 10% dropout.

Yet – this is one of THE most important aspects of trading.

In the recent ‘closed meeting’ for owners of the Market Making Scalping manual – there were lots of questions about correlations. So the timing was right to address this topic for all. In this open session, we took a deep deep dive into the market correlations to answer those questions as well as look at different uses of Market Correlations.

Considering how simple the use of correlated markets is, it is strange that so many traders overlook it. Many feel that reading 3 markets is 3 times as much work as reading 1 market. But you aren’t trying to read every tick of the related markets. You need to narrow your focus to just a few key, beneficial data points.

In this event, we revealed both the reasons these correlations exist and how to make use of them in very practical terms. We gave actionable information. Information you can implement and measure the improvements. Information that requires no leap of faith. In particular, we focused on:

• Arbitrage – the glue holding markets together

• The illusion of complexity – Why using correlated markets looks complex but isn’t.

• Market State – essential in selecting trade strategy as the trading day develops.

• Trade Confirmation/Refinement – using correlations to avoid bad trades, get better prices

• Trade Management – in with the good, out with the bad

• Short term value – Trading without price!

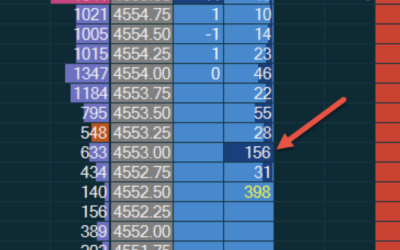

• Using Charts vs DOMs – Choosing the right tools to track correlations

• Thinner/Thicker correlated markets

Here’s the session recording:

Simplify Your Trading

Take a look into the decision making process of professional traders with this video training series that helps you make smarter trading decisions.

0 Comments