Day Trading in December – is it me or is it the market?

Over the past few months I’ve been getting to know RG from Discovery Trading group. I was introduced to them by Anthony at Stage 5 Trading, he said we’d probably get along and mentioned that RG knew FT71 (I think I need to get myself an acronym too). That’s a fairly good sign in my opinion and since then I’ve been chatting with RG and looking at what DTG offer. More on that later.

Anyway I’d like to share a quote from RG. I know some people are scratching their heads at the lack of liquidity in the ES right now and RG puts it perfectly.

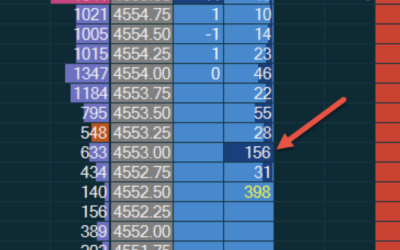

Yes, what NJ just said reminds me to remind that in a very macro sense, for the type of trading and orderflow analysis we advocate – especially what I advocate personally regarding absorption evidence around zone case, prices is absolutely positively tied in a big way to how thick the book and prints are. As soon as you start seeing mid to low hundreds instead high hundreds to thousands in the ES book and high hundreds low thousands printing that is a pretty thin market to hope for levels holding tightly with mitigated short term volatility.

In a word, thick is everything to me. This is also the main reason why pure scalpers tend to prefer trading thicker markets like the ZN and FESX instead of the ES. Thicker means less lateral movement and tighter ranges holding. Thinner means whippier but also can be better for catching bigger swings if that is your thing. You will just have to generally risk a bit more to give yourself room enough to catch them. It’s my opinion that this is perhaps the single biggest thing to get a handle on if you are an intraday trader and I don’t think I’ve ever really seen any of the educators out there saying much about it

The liquidity in December has been very low and that changes the way the market moves. Bids and offers at each level are down in the mid-low 100’s as opposed to the 1000+ we are used to. If your day trading looks for certain things, such as absorption it on the bid for a long, it’s often not at the level long enough for you to see it.

You don’t have to take trades and if the market isn’t giving you prices to lean on, you can always sit it out. You could also use this as a learning experience to try to find an edge in this market, maybe using a screen recorder to watch the action and look for clues. Another alternative is to switch to a market that is much thicker but that has now thinned out to the sort of liquidity you’d normally expect on the ES. That would effectively give you a market that is exhibiting the sort of behavior you prefer to trade. The other alternative is to just get into trades without confirmation and become more tape/power meter oriented and track post-entry delta.

Anyway, the upshot is if you are having issues in your day trading, it could be that it’s not you – it really IS the market!

Simplify Your Trading

Take a look into the decision making process of professional traders with this video training series that helps you make smarter trading decisions.

0 Comments