Cut and Reverse Drill (Crude – with video)

The Cut and Reverse drill is used in proprietary trading firms as part of their training program for new traders. It has one purpose and one purpose only – to make better traders. It’s something anybody can do and you can start right after reading this article.

Regardless of how you trade or what you trade, improving your ability to read the market in the moment will obviously pay dividends. The cut and reverse drill does exactly that but it does a lot more. Before we look at the benefits, we’d better explain what the drill is.

So what is the cut and reverse drill?

The cut and reverse drill is very simple. You sit down at your trading desk and switch to your trade simulator. Cut and reverse is a drill, a training exercise. You do NOT want to trade real money doing it.

Set aside around 60-90 minutes for the cut and reverse drill. You’ll probably lose focus after that anyway plus this is an exercise that takes mental focus, so it will be tiring. You could do 2 sessions a day and I’d advise at least 10 sessions. Then maybe you can move to another drill. Ultimately, your performance at the drill will tell you when you’ve made the gains.

Anyway – you take a position of 1 contract – long or short, it doesn’t really matter. After that you must stay in the market for the full 60-90 minutes. You can either stay with the market or reverse the trade but you absolutely cannot go flat. You cannot restart either.

These last 2 points are important. If you are not disciplined, this won’t work. If you have a crappy 15 minutes, you can’t just reset and start again. After all, you can’t do that on a live account, can you?

How do you benefit from cut and reverse?

The obvious benefit of the cut and reverse drill is improving your ability to read the ebb and flow of the market. This is something you could do just by watching the markets and we do recommend you do that for a short period. To progress, you need to get engaged with the markets and there is no better way to engage than to have a position on, even if it’s only a SIM position.

Cut and Reverse drills also Improve your ability to get out of bad trades. This benefit is twofold, first it helps you to recognize when a trade is going bad in the first place. Second, it gives you repeated practice at getting out of the way when that happens. This builds the confidence to cut trades in a live market. That’s something many trades have a hard time doing. Cut and Reverse enforces the belief that cutting trades is a good thing.

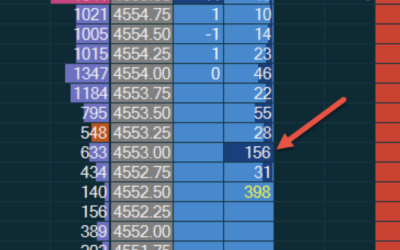

Cut and Reverse video

To demonstrate how to execute the cut and reverse drills, here’s a short video where I demonstrate the cut and reverse drills on Crude Futures. As you will see, I have no problem being on the wrong side of the market but I don’t stay there for long. You should not try to be right all the time, that’s impossible. You SHOULD target the sort of results you see in this video. Just don’t expect to get there straight away and don’t be disheartened if your initial results are poor. After all, there would be no point doing the drills if you were already good at them.

If you don’t currently feel “connected” to your market. That your market isn’t really talking to you. That your trades feel like guesswork. Than your decision to stay in or get out is an arbitrary one, then start with cut and reverse drills. Do an hour a day and soon you’ll feel connected to the market like never before.

Simplify Your Trading

Take a look into the decision making process of professional traders with this video training series that helps you make smarter trading decisions.

0 Comments