Customer Trade Videos – ZB & ES

I met Arthur a couple of weeks ago in Bangkok where ‘meet for lunch’ turned into ten people for dinner, covering 3 generations…

Based on how well they got along, I think my daughter will be marrying his son in about 20 years, so I obviously want Arthur to succeed!

Arthur asked for my comments on these but to be honest there’s not much to say. He’s doing fine. He’s leaning on the profile on the ZB in this first trade for a continuation….

https://www.youtube.com/watch?v=lBFTxb22LcI

My only comment on this is based on the ES, I’ll usually wait for more of a breakout before leaning on the profile on the way back. Every market is different though – so I’d say Arthurs experience beats mine on the ZB. For the ES – you really want to see 5-6 ticks breakout before leaning on the way back so that you can be reasonably sure some shorts got washed out, otherwise it tends to fall back into the range. Anyway – as I say Arthur has more ZB experience than me on this one.

http://www.youtube.com/watch?v=R-PqaXNng88

For this second video we have 2 trades.

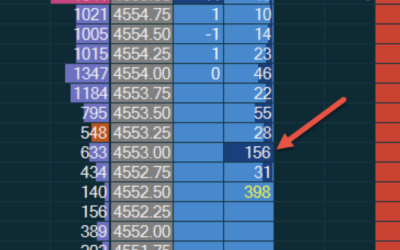

ZB – similar entry to video 1 but we hit an iceberg above. Then it went back to that area and they didn’t hit it at all. That’s a good opportunity for the market to collapse, so I think his rationale is good for not letting the iceberg push him out of the trade but wise to get out when no-one hit into the offer there 2nd time round.

ES – One of my bread & butter trades here, good to see. The rationale between having a target a few ticks past the low is that if it pierces the low on the ES, it’ll run a few ticks if stops get run, so there’s really no point in an exit at the low of the day. An exit at the low of the day puts you at the back of the queue. So you are really looking for the low of the day to break in order to get that order filled (as you are at the back). So if your trade is going to rely on the low breaking – then take advantage of the low breaking by going a few ticks past. It’s easy to critique a trade in the rear view mirror – I’m not sure I’d have gotten out of that early but I think that low -1 tick is where your target should be if you suspect it won’t break. You can’t suspect it won’t break AND expect a fill on the low of the day.

Good stuff Arthur – nice to see.

Simplify Your Trading

Take a look into the decision making process of professional traders with this video training series that helps you make smarter trading decisions.

0 Comments