Customer Question – How to tell a pullback is ending

I got this question via email today and I thought I’d reply to it here….

I wanted to ask you a question about what you find to be the best clues on the depth and sales that a pullback is ending and price is about to resume in the original direction. This is assuming we are in a trend.

A lot of the time a price might look like it is supported with more volume and about to turn and then it just turns back around and blasts through it. I know you have a lot of time watching the depth and sales and thought you might be able to give me some pointers that would help. I am trading the ES during the day session.

Any help would be greatly appreciated.

Let’s say market is moving up and pulling back down.

Chart-wise you do need to see the volume & delta accompanying the pullback to be minor. You also need to think of swing sizes in general. ES puts in swings of 2-3 points generally speaking and you should be careful not to start getting excited about a continuation trade 4 ticks off.

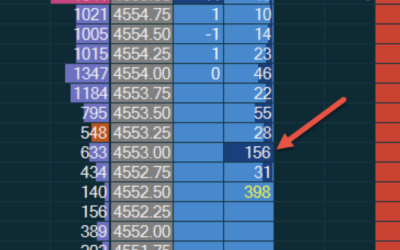

When the market moves down, you reall don’t want to see a lot of resistance on the bid size or huge amounts of volume going into the bids or offers. You need to be in tune with the pace of the selling too and this is why I always keep Reconstructed Tape running next to Depth & Sales.

As it comes into the area, you will quite frequently see that trading simply dries up. It just comes down into the area you expect the pullback to end and just stops. That’s a fairly aggressive entry if you take that.

As you mentioned, the other thing you often see is a bidder that is refreshing and absorbing the selling. Like you say though it can blast straight through this and carry on down. I think some of this is down to ‘feel’. If someone is refreshing the bids but sell market orders are rapidly firing into it (and large ones too), then even if the bidder takes on 5 or 6,000 contracts, I figure they’ll keep hitting it. If that occurs, you have to change your bias to short and it is this exact place (the bid iceberg) you should be looking at for a short when it comes back up as that is where sellers stepped up and overpowered the bidders. For a in iceberg long in a pullback, I like to see sellers hitting into it at a more leisurely pace.

I also want to see sellers hitting into it a bid and it holding over a longer period of time. If sellers hit 4000 contracts into that bid in 20 seconds, I will hold off. If sellers are hitting into it for minutes, then obviously everyone sees that and it gives people more time to second guess themselves.

Whichever of the above occurs – an iceberg OR sellers fading away, you always have the option of waiting for the buyers to step in and move price up a few ticks for confirmation. At this point though, it probably wont take a lot of contracts to move price up 3 ticks and so you do have to accept a poorer price if you wait for that. If you find you are jumping in too early all the time, then I would look to wait for the buyers to confirm things.

There isn’t much more to it than that. What I would do in your case is to start videoing the trades and then make a compilation of them you can review or that we can review together.

Cheers

Pete

Simplify Your Trading

Take a look into the decision making process of professional traders with this video training series that helps you make smarter trading decisions.

0 Comments