Jigsaw’s Black Friday – Unleashing the Best Prices of the Year!

Jigsaw’s Black Friday Sale Is Still ON

Get All The Tools And Education You’ll Need To Trade Like a Pro

(Save Over $250)

(Only 20 coupons have been added, and the offer expires at midnight on November 30)

Trader!

Our Black Friday Sale has arrived.

For a limited time, get massive discounts on Jigsaw’s acclaimed trading tools and education.

But don’t dive in just yet. First, here are the 3 Golden Rules you must know before you scroll down to GET your deal:

- Golden Rule #1 – Just 20 Coupons Available.

- Golden Rule #2 – Strictly 1 discount per customer. We have eyes in the back of our heads, so don’t try to pull any fast ones!

- Golden Rule #3 – Offer Expires Midnight, November 30.

If you were thinking of getting one of Jigsaw’s packages but were hesitant for any reason, now is your chance…

And if you’re new to Jigsaw and want to learn more about how we provide traders like you with the tools and education that professionals use to consistently make money in the market…

Then I strongly recommend you to click here to get a sense of what we have to offer>>

And if you’re one of our loyal customers, scroll down to find your Black Friday deals.

Now let’s cut to the chase:

KEYNOTE: Pick the best DEAL for you, but make sure you Secure your discount before November 30th – or before 20 others beat you to it!

For new customers, you can get:

1. daytradr Independent

Was: $579 | Now: $479 ($100 discount – use code BF-100 or Claim Your Deal Here>>)

2. daytradr Professional

Was: $879 | Now: $729 ($150 discount – use code BF-150 or Claim Your Deal Here>>)

2. daytradr Institutional

Was: $1979 | Now: $1729 ($250 discount – use code BF-250 or Claim Your Deal Here>>)

For existing customers, you can:

1. Add on Institutional & Advanced Training

Was: $1647 | Now: $1397 ($250 discount – use code BF-250)

2. Add on Advanced Training

Was: $349 | Now: $249 ($100 discount – use code BF-100)

3. Annual Live Trade & Journalytix (with live news)

Was: $500 | Now: $400 ($100 discount – first year only use code BF-100)

In addition, the following special offers have been added for existing/new customers:

1. Journalytix Annual

Was: $399 | Now: $299 ($100 discount – first year only use code BF-100 or Claim Your Deal Here>>)

2. Institutional Education (For non-platform Users)

Was: $1347 | Now: $1147 ($200 discount – use code BF-200 or Claim Your Deal Here>>)

Conclusion:

Whether you’ve been trading for a long time and have yet to find anything that works…

Or maybe you’re almost there and just need a little push to get to constant profitability…

Or maybe you’re making good money and want to get even more ahead…

We have the right package for you…

Now is the perfect time to join at the best prices ever>>

But Remember, these deals are disappearing fast. Secure your discount before November 30th – or before 20 others beat you to it!

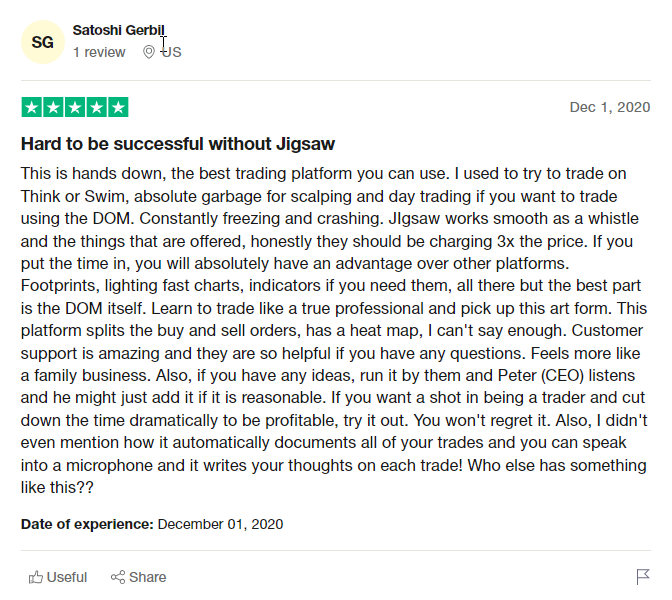

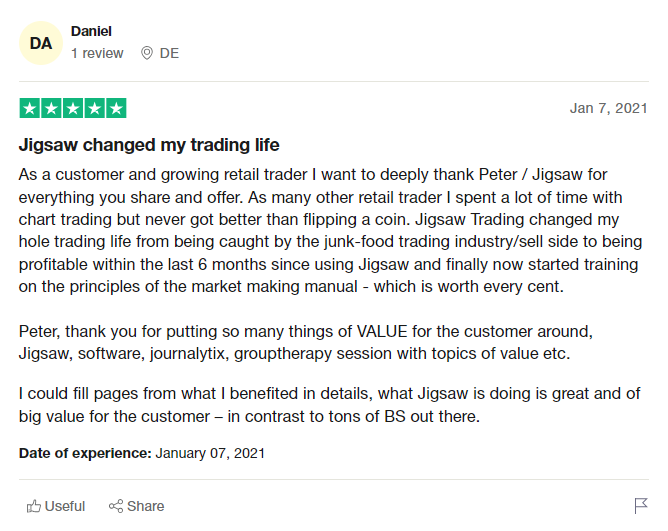

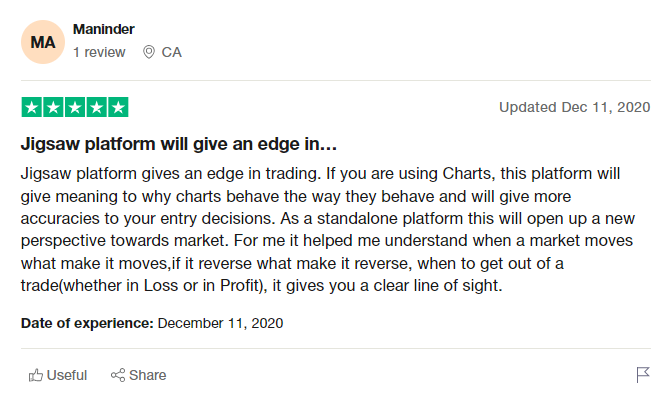

Let’s have a look at what our customers are saying about us:

Simplify Your Trading

Take a look into the decision making process of professional traders with this video training series that helps you make smarter trading decisions.

0 Comments