$30k profit (DAX/ES), 30% Profitable Traders – January Leaderboard Results

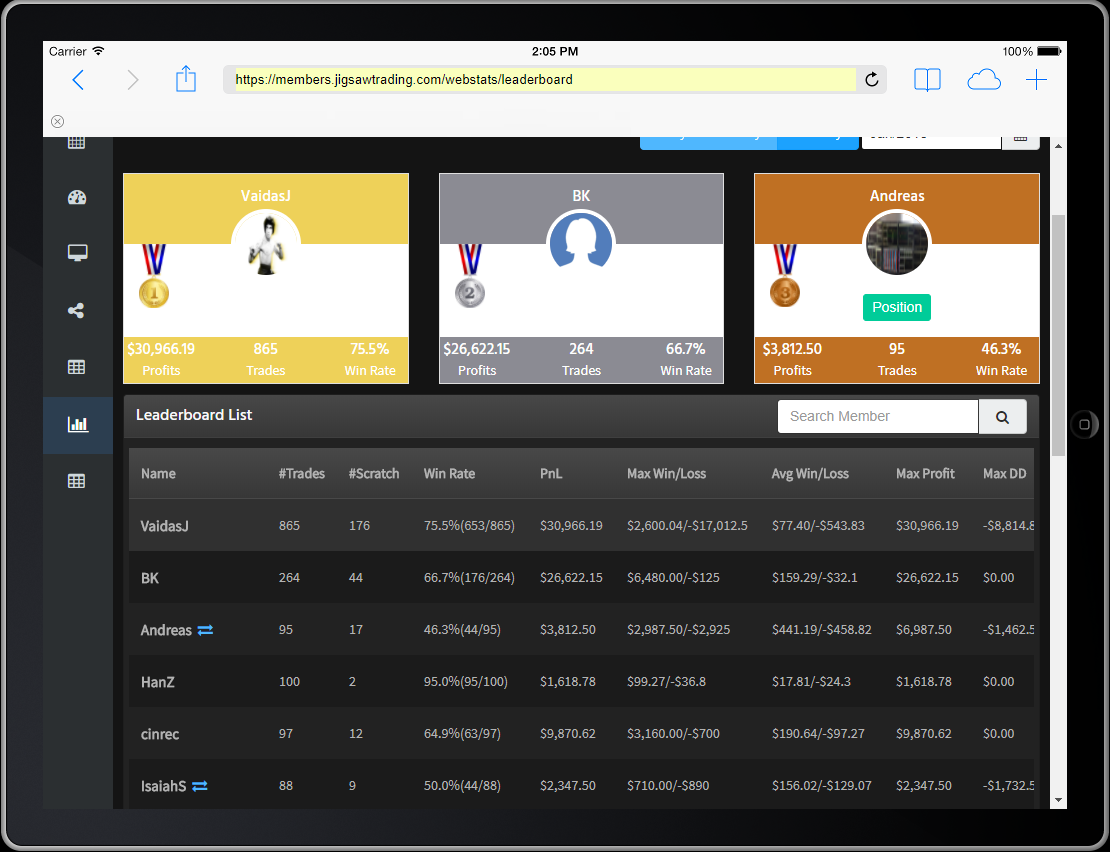

Congratulations to Vaidas for winning the Jigsaw leaderboard contest for a second month running.

The leaderboard ranks traders by a proprietary consistency rating algorithm. P&L is NOT taken into account at all. Normally, the most consistent trader is the most profitable. Which is the whole purpose of the consistency rating. To show people that consistent behavior leads to profit.

Swinging wildly for the fences will not put you at the top of the leaderboard. People still try though!

Vaidas got a rating of 69 in January. He took 865 trades, with a 75.5% win rate. He is playing a skewed R:R strategy with winners significantly larger than his losers. There was a big drawdown day but he managed to claw it back and with very consistent trading and end up for the month. This skewed R:R has worked for him for 2 months. It’s also worked so far this month, in drastically different trading conditions.

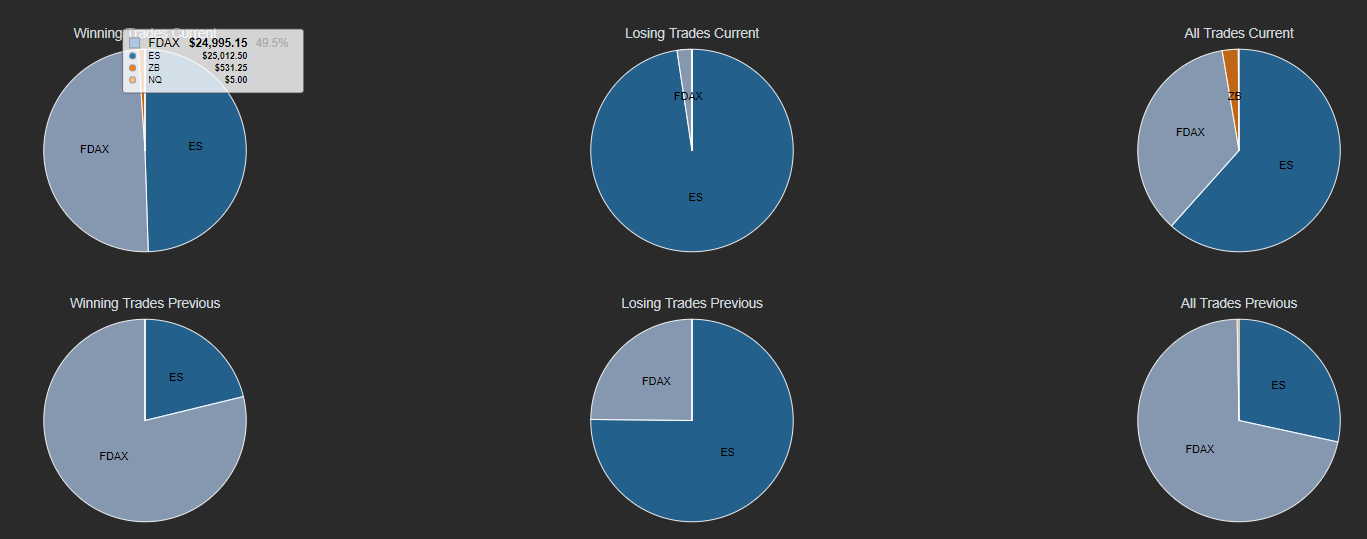

Profits come mostly at 11am and 6pm in his time zone (GMT+2), What is interesting is that Fridays are losers overall for him. The choice of instruments is interesting. We can see below that in January the wins were about 50% DAX and 50% ES. Last month was 75% DAX. In terms of losses, the ES contributed the most. So Vaidas is a trader that loves volatility – which bodes well for him in February.

Congratulations to Vaidas and congratulations to the other participants. In January, 30% of the participants made a profit – although a modest one in many cases. Consistency overall is on the increase and we’ve been getting a lot of emails from participants about the positive impact of the ratings system on their trading.

So if you aren’t on board yet, follow the instructions here to hook your daytradr™ platform up to the statistics server and here to join the leaderboard.

Simplify Your Trading

Take a look into the decision making process of professional traders with this video training series that helps you make smarter trading decisions.

0 Comments