Buying on the bid.

I got the following through on an email today and I figured the reply might benefit a few people:

I have three questions.1-I put a buy order on the Bid. I get filled and the market didn’t move from the Bid.What happened ? How did I get filled ?2-I put a sell order on the Ask. I get filled and the market didn’t move from the Ask.What happened ? How did I get filled ?3-What are the clues that I may buy on the Bid or sell on the Ask and get filled ?Thank you and have a nice day,

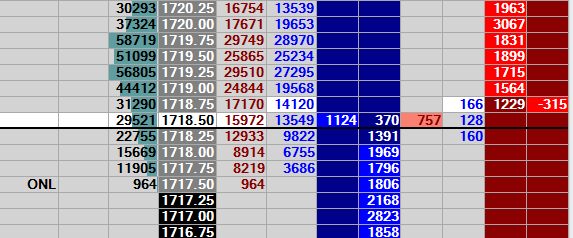

Look at the inside bid – 370 contracts bid, 757 contracts traded, 1124 contracts added at that price.

As I was watching this, the actual bid qty was around 200-400 for the whole time that the 757 contracts were trading. Someone was adding contracts to the bid – an iceberg order. So if you’d seen 400 trade there and put an order in, you’d have gotten a fill.

Iceberg orders are quite common, you can join one, especially if the number of contracts shown is small like this. If they are showing 400 and have traded 1,000, then if you join it, you have a good chance of a fill. On the other hand, if they are showing 2,000 and have traded 4,000 they may well be done and anyway – you have 2,000 in front of you. Less chance of a fill and more chance of it going straight through by the time it does fill you.

The problem is that much of the time, you can join the bid and price will just carry on through. If you are trying to figure out how to buy the bid and sell the offer, then this won’t help. My rule of thumb on the ES is to not lean on an iceberg that is counter to the market direction. So don’t expect an iceberg to stop an intraday trend but DO expect an iceberg to stop a pullback.

IMO a better trade when you see this sort of activity to watch the offer side. You know someone is refreshing the bid but in the image above, you can see 1229 offered, 315 contracts PULLED from the offer and 166 contracts traded. If I thought those bids were going to stop the market, I’d wait for that 1229 offers to start reducing 1200… 1100… 1000… 800… 700.. 600.. 500.. 400 and then I’d hit a market buy order into that offer knowing that there is a good chance that price will quickly move through that offer and I’m then sitting on a break-even trade. This is especially true if there’s pulling of offers on the inside level and above.

Cheers

Pete

FREE BONUS: Take a look into the decision-making process of professional traders with this video training series that helps you make smarter trading decisions.

0 Comments