Crude Scalper & Jigsaw user funded at TopstepTrader.

We often get asked “Does Order Flow apply to thin markets like Crude or is it just for thick instruments?“.

To answer, here is a great story from “CSSTrader” (his pseudonym on TopstepTrader), a trader that first started looking at trading 4 years ago and recently became a Funded Trader at TopstepTrader

Like many traders, he went through the indicator phase and he’s now trading a funded account using just a 1 minute chart and Jigsaw tools with the volume profile.

He’d done a few Combines at TopstepTrader but hadn’t managed to pass a combine, which is needed to get a funded account there.

He then went on to review the interviews of some of the most successful Combine traders (the results are available publicly) and listened to their “New Funded Trader” interviews to find out what they were doing that he wasn’t. Many of them discuss the Order Flow aspect of trading and many are users of the Jigsaw tools.

After hearing other Topstep funded traders talk about Jigsaw, he decided to give the tools a try.

His trading improved dramatically.

- He became a lot more confident, going from taking 1-2 trades a day to over 20 trades per day.

- Tightened his stop losses from 8-12 ticks to 3-5 ticks (including slippage).

- He had his highest winning days ever.

- He went on to pass the combine and the following Live Trader Prep and got a funded account at TopstepTrader.

All using just 1 minute “naked” charts and Jigsaw Tools with a volume profile.

Here’s the Newest Funded Trader Interview where CSSTrader talks about his journey and what he feels was key in his development as a trader.

He’s even helped improve the product too – in the interview, he mentioned having an issue with the sort of execution speed on order changes he needed. As soon as we heard that, we had a chat and worked out a solution to his issues, including a small change to the Jigsaw tools.

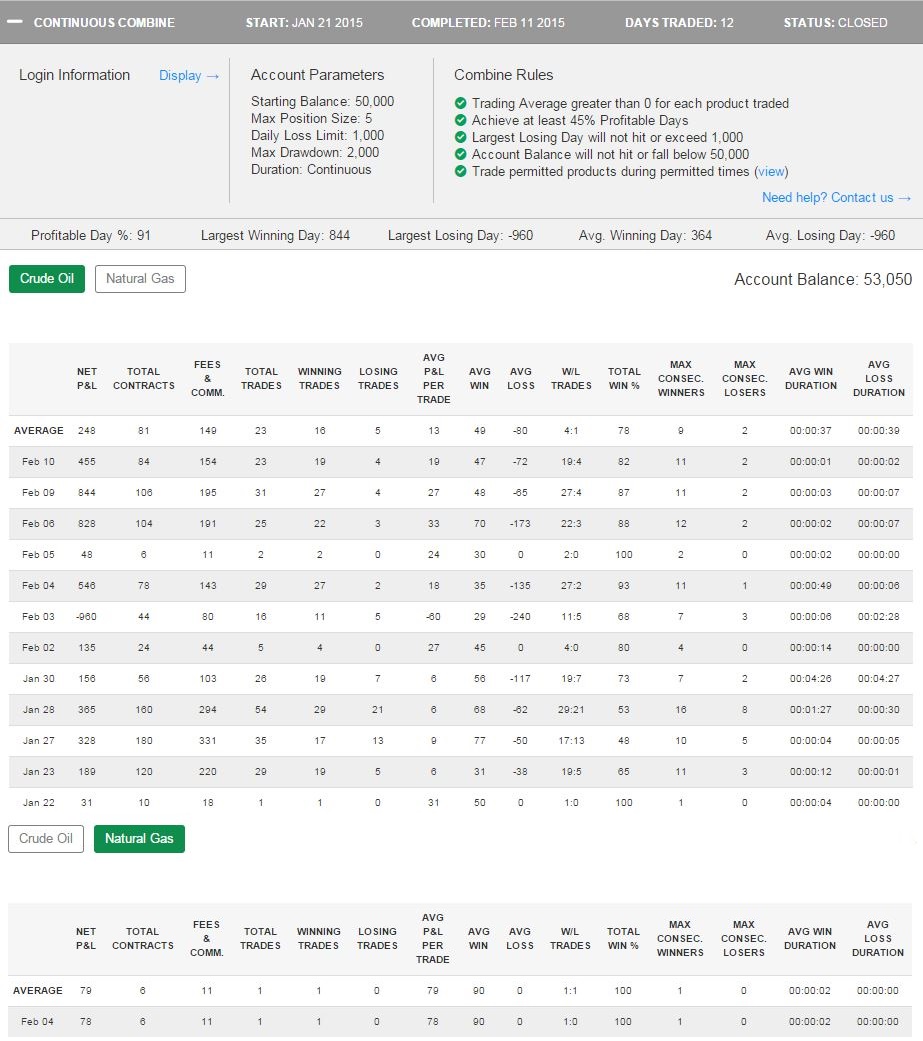

You can see his combine results here (click for larger version):

FREE BONUS: Take a look into the decision-making process of professional traders with this video training series that helps you make smarter trading decisions.

0 Comments