Auction Vista – One customer’s experience – with results!

I got an email a few days ago from a Jigsaw customer that has been with us since March 2015. He’s a big fan of Order Flow but never found much benefit in the Market Depth for Day Trading.

In the Jigsaw “Introduction to Order Flow” video, we explain that all Order Flow tools exist for pretty much the same reason, they present Order Flow information in various formats but effectively for the same underlying reason and “Auction Vista” is no exception. With this release, this particular customer has now found he can incorporate Market Depth in his trading. Here is the email:

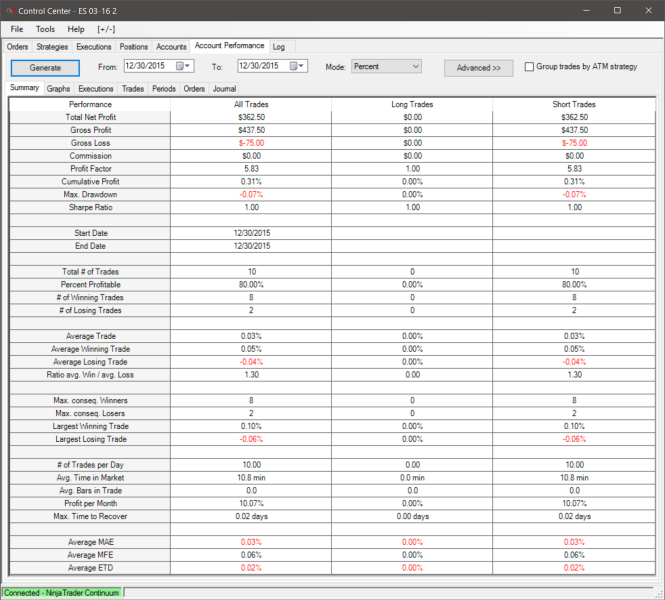

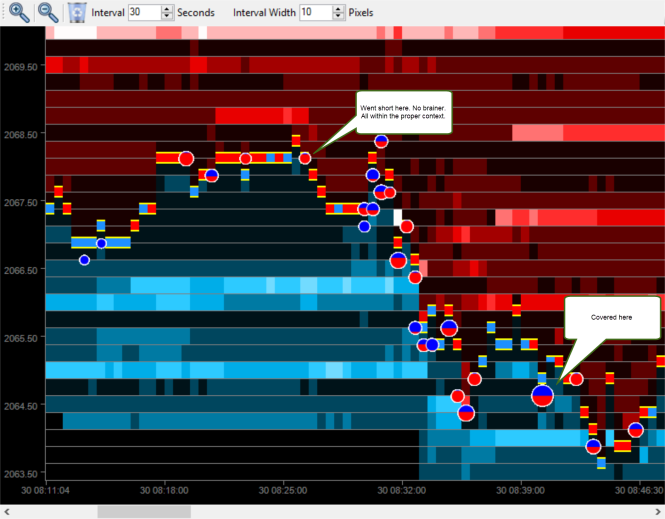

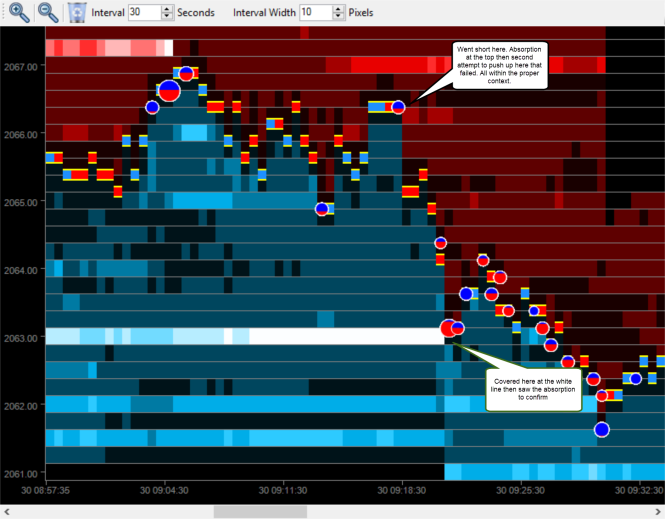

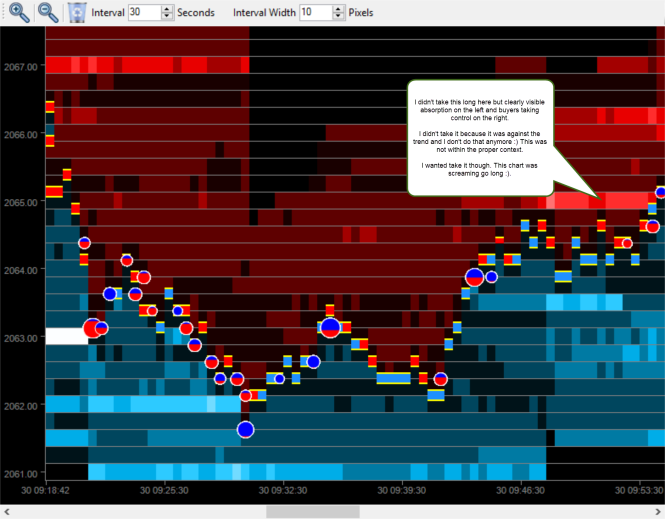

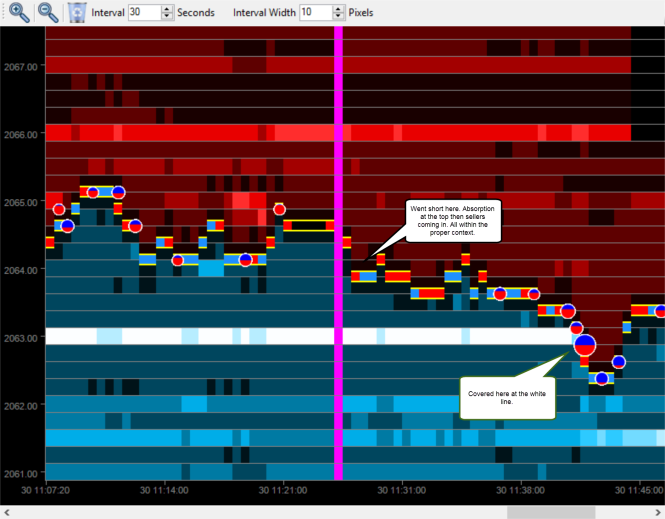

Well you win 🙂 Until this heatmap I was totally against using depth of market, as you know. However, I was checking the heatmap out before the market opened and thought, “hmmmm, interesting, I think I will give this a go today. Why not? It should be a slow day and I will just trade 1 lots.” Below is how my day ended. I have also included some of the trade screenshots below. Great job on this heatmap, I am digging it!

It was actually kind of strange because I hate adding new stuff and have a very simple workspace, as you also know. However, after assessing the Oder Flow Heatmap, for less than 5 minutes by the way, it just seemed to be a natural fit. It immediately made total sense and it appeared to require little thinking on my part. The “little thinking” part is paramount because I don’t want it to change my current trading and thinking process that is working but rather, if possible, enhance it. I am pleased to report that Jigsaw’s new Order Flow Heatmap enhanced my current trade process… naturally and organically. It was seamless, smooth and effective incorporating it today. Great job!!!

Click On the Images to see Full Size:

0 Comments