Stormy December – Navigating These Treacherous Markets – Podcast

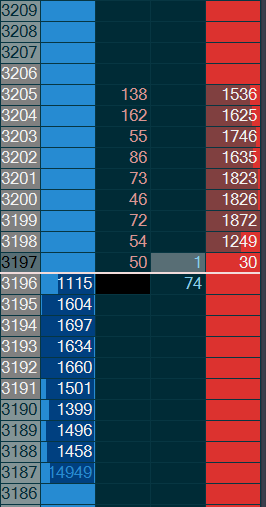

There’s a link below to our recent podcast at TopstepTrader. Before we look at that, I’d like to quickly go over a screen shot, sent by a customer, that really highlights what’s going on with these ultra-volatile market conditions we are having at the moment.

The EuroStoxx 50 is quite a slow, liquid market. Much slower than the S&P500 Futures on CME. There we are seeing the same effect – but magnified. It is not at all unusual for us to move 8 ticks in an instant. So while an 8 ticks stop would generally be considered conservative in normal times, right now – it’s asking to be stopped out.

The cause of all this? Well, it seemed to coincide with the “US/China Trade War” – which has been a lot of posturing and threatening. When something like this (or a looming war) is in the news, we have seriously increased news risk. Unlike market moving events like employment numbers, news about the trade war can come at any time. So the market is nervous and liquidity providers have taken a big step back. Add on to this the fact that Brexit hit the headlines in the past few days again – now we have 2 VERY significant current news events that can swing the market massively at any time. The fact that a Chinese executive just got arrested in Canada isn’t helping much either. It’s the perfect storm.

The scale of the HFT/Algo world is not to be underestimated. Knight Capital once lost $440,000,000 in just 30 minutes. You can hardly blame people that trade this way for stepping to one side in the current environment. So, while we know “HFTs provide much needed liquidity”, we also know they tend to do it “when we don’t really need it”.

So what to do? Personally, I think if you are not an expert in Index Futures, you should not be trading them untill they settle down. If you do trade them, you need to change approach. Other markets like Crude, Gold, Bund, Euro Futures – have been quite stable even during times when the S&P is going wild. Grains, Meats, Metals – might seem a bit tame but for newer traders, they are much safer markets right now. The last time we had volatility close to this was 2015. In my opinion what we have now is worse. This will pass – but you want it to pass without blowing up your account. For newer traders, the S&P, Nasdaq and DOW index futures should be avoided right now. They aren’t going anywhere and they will get back to normal at some point. The smartest thing is to preserve your capital and not get involved in this ‘wild west’ type of trading.

My thoughts on this and other topics are discussed in this one on one “Limit Up” Chat with my friend Eddie at TopstepTrader. It give you ideas of how to adjust strategy in these ‘interesting times’.

Stay Safe!

BONUS: Take a look into the decision making process of professional traders with this video training series that helps you make smarter trading decisions.

0 Comments