Where are my Orders (PC or Exchange?)

Two of the most common questions that come up with trading platform users are:

- “where do my orders sit? My PC or the exchange?”

- “will my orders be executed if the internet connection is lost?”

It depends on the type of orders and your data provider functionality. We attempt to keep functionality the same across data providers – so even if your provider doesn’t support an order type, we will emulate that order type locally.

We call these locally processed orders “Local Orders”

Local Orders – Orders or parts of orders where the processing is done in daytradr. Let’s walk through the order types that may be local.

Strategies – Strategies themselves that add exit order/brackets as you get filled on your position are processed locally on your PC. If you are online and you get a fill, the strategy will add your exit orders. If you are offline it will not. This is standard across retail trading applications.

OCO Pairs – When an OCO Pair is created, the cancel of the “other side” when one side is filled/cancelled is normally done on the server BUT there are different OCO policies that the data providers use:

- FOCCA – Fill or Cancel Cancels Other (what most people expect to happen)

- CCA – Cancel Cancels Other (other order is only cancelled when an order is cancelled)

- FCA – Fill Cancels Other (other order is only cancelled when an order is filled)

If the data provider is not FOCCA, then daytradr will do the ‘other cancel’ locally so that it always appears to be FOCCA. Here’s the policies of the different providers:

- CQG -FCA -Cancel other when you cancel an order is daytradr side. Which should be ok for offline execution as you won’t be cancelling orders when you are offline.

- GAIN – FOCCA – All server side.

- IB – FOCCA – All server side.

- MT5 Bridge – FOCCA.

- NinjaTrader 8 Bridge – FOCCA.

- Rithmic – FOCCA – All server side.

- Tradovate -FCA -Cancel other when you cancel an order is daytradr side. Which should be ok for offline execution as you won’t be cancelling orders when you are offline.

In all cases, if the OCO pair contain an internal volume stop, the OCO cancelling will be done internally in daytradr.

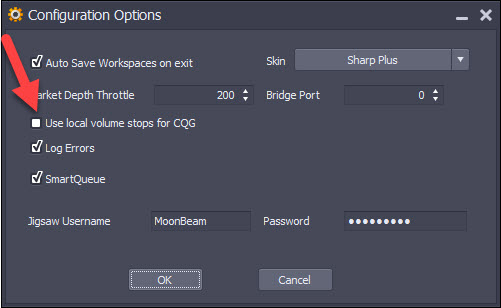

Volume Stops – Volume stops are mostly internal, most providers do not support them. The exception is CQG who do support volume stops. Their volume stop rules are available if you click here. Note that you can override the CQG volume stop logic and use Jigsaw Internal Volume Stops with this setting:

Trailing Orders – daytradr supports trailing limit and stop orders.

- Trailing Limits – Only supported by CQG. All other trailing limits are internal orders.

- Trailing Stops – All trailing stops are internal orders.

Jigsaw SIM Account Orders – these are all processed locally.

Other orders – other orders such as regular limit, stop limit and stop orders are exchange/server side.

FREE BONUS: Take a look into the decision-making process of professional traders with this video training series that helps you make smarter trading decisions.

![[Postponed] What Prop Futures Traders Are Really Like – Live Session](https://test.jigsawtrading.com/wp-content/uploads/2025/09/ChatGPT-Image-Sep-11-2025-06_00_29-PM-400x250.png)

0 Comments